All Categories

Featured

Table of Contents

- – How do I get started with Passive Real Estate ...

- – What should I look for in a Real Estate Invest...

- – Why is Accredited Investor Real Estate Platfo...

- – Are there budget-friendly Real Estate Crowdfu...

- – Why should I consider investing in Accredite...

- – Why should I consider investing in Passive R...

For instance, rehabbing a home is taken into consideration an energetic investment strategy. You will supervise of collaborating renovations, managing contractors, and eventually ensuring the residential property offers. Active techniques need even more time and initiative, though they are related to big revenue margins. On the other hand, easy property investing is great for capitalists that desire to take a much less engaged approach.

With these strategies, you can take pleasure in passive revenue over time while enabling your financial investments to be taken care of by another person (such as a property administration company). The only point to keep in mind is that you can lose out on some of your returns by hiring a person else to manage the investment.

One more factor to consider to make when selecting a real estate investing approach is straight vs. indirect. Straight financial investments entail in fact acquiring or handling homes, while indirect techniques are less hands on. Many capitalists can obtain so captured up in recognizing a building type that they do not understand where to begin when it comes to locating a real building.

How do I get started with Passive Real Estate Income For Accredited Investors?

There are bunches of residential properties on the marketplace that fly under the radar due to the fact that financiers and property buyers don't understand where to look. Several of these properties endure from inadequate or non-existent marketing, while others are overpriced when listed and therefore fell short to get any type of attention. This suggests that those capitalists eager to arrange via the MLS can locate a variety of financial investment possibilities.

This method, investors can continually track or look out to brand-new listings in their target area. For those wondering just how to make links with genuine estate agents in their particular areas, it is a great idea to participate in neighborhood networking or real estate occasion. Capitalists browsing for FSBOs will additionally locate it helpful to function with a realty representative.

What should I look for in a Real Estate Investment Funds For Accredited Investors opportunity?

Capitalists can also drive via their target locations, trying to find signs to find these buildings. Keep in mind, recognizing buildings can take time, and investors need to be prepared to use multiple angles to protect their following deal. For investors staying in oversaturated markets, off-market buildings can represent a chance to obtain in advance of the competitors.

When it comes to looking for off-market properties, there are a couple of resources capitalists must inspect. These include public documents, genuine estate auctions, dealers, networking events, and service providers.

Why is Accredited Investor Real Estate Platforms a good choice for accredited investors?

Years of backlogged repossessions and enhanced motivation for banks to reclaim might leave even more foreclosures up for grabs in the coming months. Capitalists looking for repossessions must pay careful focus to paper listings and public records to find possible buildings.

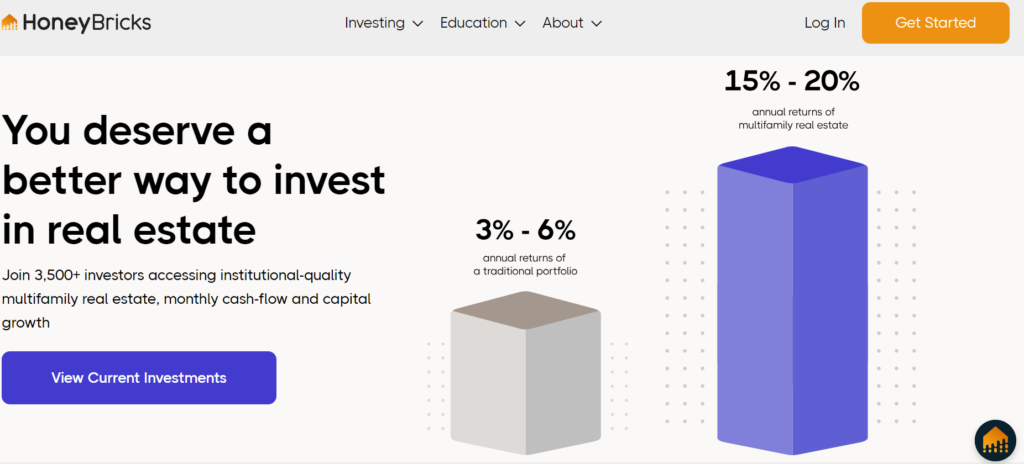

You must take into consideration purchasing realty after learning the various advantages this possession has to use. Historically, property has performed well as a possession course. It has a favorable relationship with gross residential item (GDP), indicating as the economy expands so does the demand genuine estate. Usually, the regular demand offers realty lower volatility when contrasted to other financial investment types.

Are there budget-friendly Real Estate Crowdfunding For Accredited Investors options?

The reason for this is because actual estate has reduced connection to other financial investment kinds therefore offering some securities to investors with other possession types. Various sorts of real estate investing are associated with different degrees of risk, so make sure to locate the appropriate financial investment method for your objectives.

The procedure of buying residential or commercial property involves making a down payment and funding the remainder of the sale price. Consequently, you only pay for a small portion of the residential or commercial property up front but you control the entire financial investment. This type of take advantage of is not available with other financial investment kinds, and can be used to additional expand your investment portfolio.

Nevertheless, due to the wide array of alternatives offered, many financiers likely find themselves wondering what actually is the most effective property investment. While this is an easy concern, it does not have a basic answer. The finest sort of financial investment home will certainly depend upon lots of elements, and investors should beware not to eliminate any type of choices when looking for possible bargains.

This write-up checks out the opportunities for non-accredited financiers aiming to venture into the financially rewarding world of actual estate (Real Estate Syndication for Accredited Investors). We will explore numerous investment opportunities, regulatory factors to consider, and strategies that encourage non-accredited individuals to harness the possibility of realty in their investment profiles. We will certainly additionally highlight exactly how non-accredited capitalists can function to become recognized financiers

Why should I consider investing in Accredited Investor Real Estate Platforms?

These are typically high-net-worth individuals or firms that fulfill accreditation demands to trade private, riskier investments. Revenue Specifications: Individuals must have an annual income going beyond $200,000 for two successive years, or $300,000 when incorporated with a spouse. Internet Worth Demand: An internet worth going beyond $1 million, omitting the main home's value.

Investment Expertise: A clear understanding and understanding of the threats connected with the investments they are accessing. Paperwork: Capability to supply economic statements or various other documentation to verify earnings and internet worth when asked for. Property Syndications require recognized investors since sponsors can just allow recognized capitalists to sign up for their investment possibilities.

Why should I consider investing in Passive Real Estate Income For Accredited Investors?

The initial common misunderstanding is once you're a certified financier, you can keep that status indefinitely. To end up being an accredited capitalist, one have to either strike the income standards or have the net well worth requirement.

REITs are appealing because they produce more powerful payments than typical stocks on the S&P 500. High return returns Profile diversity High liquidity Rewards are tired as common income Sensitivity to rates of interest Threats related to details residential properties Crowdfunding is a method of on-line fundraising that entails asking for the general public to contribute cash or start-up resources for brand-new jobs.

This enables entrepreneurs to pitch their ideas directly to day-to-day web users. Crowdfunding offers the ability for non-accredited financiers to become investors in a firm or in an actual estate building they would not have actually been able to have accessibility to without accreditation. Another advantage of crowdfunding is portfolio diversification.

In several instances, the financial investment applicant requires to have a track document and is in the infancy stage of their project. This might suggest a higher risk of shedding a financial investment.

Table of Contents

- – How do I get started with Passive Real Estate ...

- – What should I look for in a Real Estate Invest...

- – Why is Accredited Investor Real Estate Platfo...

- – Are there budget-friendly Real Estate Crowdfu...

- – Why should I consider investing in Accredite...

- – Why should I consider investing in Passive R...

Latest Posts

Tax Property Sale List

Property Tax Delinquent

Free Tax Foreclosure

More

Latest Posts

Tax Property Sale List

Property Tax Delinquent

Free Tax Foreclosure