All Categories

Featured

Table of Contents

You can add these to a supply profile to obtain some direct exposure to property without the initiative of situated or vesting offers. Historically returns have actually been excellent with REITs but there is no guarantee or warranty and they will fluctuate in worth swiftly. Right here are some advantages and downsides of REITs: REITs are highly fluid investments since they are traded on stock market, allowing investors to purchase or offer shares any time they want.

REITs are subject to substantial regulative oversight, consisting of coverage demands and compliance with specific income circulation policies. This level of policy provides openness and capitalist security, making it a fairly risk-free alternative to avoid scams or untrustworthy operators. Historically, REITs have delivered affordable returns, usually comparable to or even exceeding those of stocks and bonds.

Why should I consider investing in Accredited Investor Real Estate Platforms?

This can result in potentially higher returns and favorable tax obligation treatment for capitalists. While REITs can give diversity, several spend in commercial properties, which can be at risk to economic downturns and market variations.

For instance, office and multifamily REITs might be dealing with significant disturbance in the coming year with elevated rate of interest and minimized need for the possession. I have stated several times the following chance is most likely commercial genuine estate since those are the properties that have one of the most room to fall.

Who offers the best Real Estate Crowdfunding For Accredited Investors opportunities?

You will certainly never ever listen to concerning these unless you know a person that knows somebody that is involved. Comparable to a REIT, these are pools of money used to get genuine estate. Below are some advantages and negative aspects of an exclusive realty fund: Personal realty funds can possibly provide higher returns contrasted to openly traded REITs, and other options, due to the fact that they have the flexibility to invest directly in residential or commercial properties with the objective of making the most of revenues.

Purchasing a private fund gives you accessibility to a varied profile of property possessions. This diversification can assist spread out risk throughout different home types and geographic places. There are many realty funds that either concentrate on property property or have property realty as part of the overall profile.

Fund managers are normally experts in the property industry. They make notified financial investment choices, conduct due persistance, and actively take care of the possessions within the fund to enhance returns. Because they do this complete time, they have the ability to locate far better bargains than a lot of part-time energetic financiers - Real Estate Crowdfunding for Accredited Investors. Generally, the supervisor of the fund will take a cost for their effort, yet they additionally contract out the management at the possession degree developing additional separation between you and the underlying properties.

These investments are restricted to recognized investors only. The definition of an approved capitalist is a little bit wider than this but in general to be accredited you need to have a $1 million internet well worth, exclusive of your key home, or make $200,000 as a single tax payer or $300,000 with a spouse or companion for the previous two years.

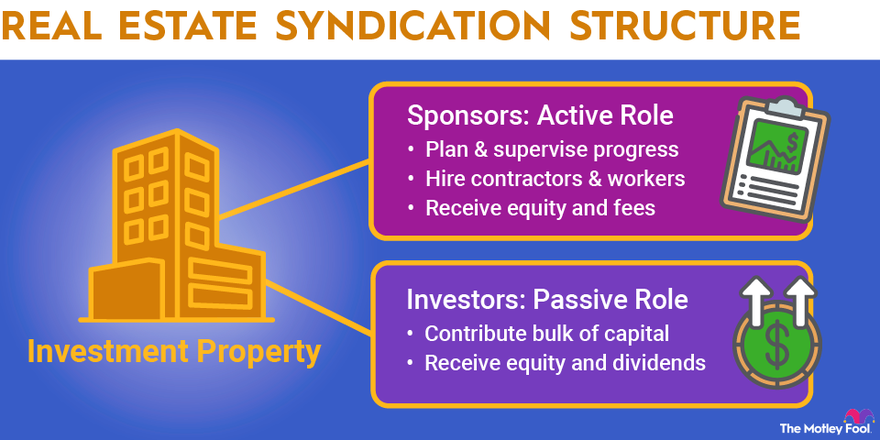

The difference is a fund is generally bought several projects while submission is normally restricted to one. Apartment or condo syndications have actually been extremely popular recently. Right here are some advantages and downsides of a submission: One of the primary benefits of lots of realty submissions is that investors may have a say in the property's administration and decision-making.

What should I know before investing in Real Estate For Accredited Investors?

Effective submissions can produce considerable earnings, especially when the residential property values in value or generates constant rental income. Financiers can gain from the residential or commercial property's financial efficiency. I have actually made returns of over 100% in some submissions I purchased. Submissions can be very conscious modifications in interest prices. When rates of interest rise, it can enhance the cost of financing for the home, potentially affecting returns and the overall stability of the investment.

The success of a syndication greatly depends upon the proficiency and honesty of the driver or sponsor. Current cases of scams in the syndication room have actually elevated worries regarding the dependability of some operators. There are a handful of considerable examples however none smaller sized than the current Grant Cardon accusations.

Exiting a submission can be testing if it is even possible. If it is allowed, it usually needs finding another financier to buy your risk or else you may be forced to wait up until the home is marketed or refinanced. With extremely uncommon exceptions, these investments are booked for certified investors just.

This is investing in a pool of money that is made use of to make financings against genuine estate (Accredited Investor Real Estate Investment Groups). Rather of having the physical property and undergoing that possible downside, a home mortgage fund only spends in the paper and makes use of the real estate to protect the financial investment in a worst-case circumstance

They create income through rate of interest settlements on home loans, supplying a foreseeable capital to financiers. Payments come in no matter an occupant being in location or rental performance. The asset does not shed worth if real estate values drop, assuming there is no default, due to the fact that the property is a note with an assurance of payment.

This permits for constant regular monthly settlements to the capitalists. Unlike personal funds and submissions, mortgage funds usually supply liquidity choices.

Real Estate For Accredited Investors

It is not as liquid as a REIT but you can obtain your investment back if required. Perhaps the largest advantage to a home mortgage fund is that it plays an essential role in boosting neighborhood communities. Mortgage funds do this by offering loans to investor for home rehab and growth.

The one possible disadvantage is that you may be offering up on possible returns by buying a stable asset. If you are alright taking losses and wish to wager for the higher return, one of the other fund options might be a better fit. If you are searching for some steady diversification a home loan fund may be a good addition to your portfolio.

Exclusive Real Estate Crowdfunding Platforms For Accredited Investors

The Stocks and Exchange Payment (SEC) has certain laws that investors require to satisfy, and commonly non recognized investors don't meet these. Nonetheless, for those that do, there is an opportunity to buy startups. Crowdfunding systems currently supply non accredited financiers the possibility to invest in equity of start-ups easily, by bypassing the SEC policies and being able to invest with a low ahead of time resources amount.

Table of Contents

Latest Posts

Tax Property Sale List

Property Tax Delinquent

Free Tax Foreclosure

More

Latest Posts

Tax Property Sale List

Property Tax Delinquent

Free Tax Foreclosure